Treno.Finance

Treno.Finance empowers crypto investors with essential risk management tools for informed, confident decision-making.

Visit

About Treno.Finance

Treno.Finance is a cutting-edge platform designed specifically for crypto investors who prioritize risk management in their investment strategies. By transforming intricate on-chain data into actionable financial insights, Treno empowers users to make informed decisions regarding asset valuations, portfolio tracking, risk signals, and lending exposures. Unlike traditional blockchain explorers that often bombard users with overwhelming information, Treno focuses on delivering clarity, context, and capital protection. This makes it an indispensable tool for serious investors looking to mitigate risks and enhance their portfolio performance. Whether you are managing stablecoin allocations or navigating the complexities of DeFi positions, Treno.Finance provides structured data that enables smarter decision-making and proactive risk management.

Features of Treno.Finance

Comprehensive Risk Assessment Dossiers

Treno.Finance offers in-depth analysis through its Risk Assessment Dossiers, providing users with essential insights into various DeFi protocols. These dossiers include forensic failure studies and risk modeling tailored for institutional investors, equipping them with the knowledge needed to navigate potential pitfalls in the crypto landscape.

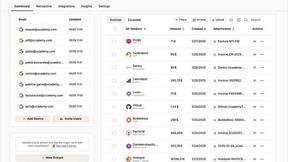

User-Friendly Dashboards

The platform features intuitive dashboards that present complex data in a structured and easily digestible format. Users can track their portfolios and monitor various assets without the usual clutter, allowing for a streamlined experience that focuses on crucial financial metrics.

Portfolio Management Tools

Treno.Finance includes robust portfolio management tools that help investors assess their exposure to different assets, including stablecoins and Ethereum. These tools enable users to make informed decisions about their investments by providing real-time data on performance and risk factors.

Strategic Insights and Educational Resources

Treno.Finance goes beyond analytics by providing educational resources such as strategy papers and e-books. These materials cover essential topics like stablecoin strategies and market analysis, helping investors develop a deeper understanding of the crypto market and make strategic decisions based on current trends.

Use Cases of Treno.Finance

Risk Mitigation for Institutional Investors

Institutional investors can leverage Treno.Finance to conduct thorough risk assessments of their DeFi positions. By utilizing the platform's detailed analyses, they can identify vulnerabilities and strategically adjust their portfolios to minimize potential losses.

Comprehensive Portfolio Tracking

Individual investors benefit from Treno's portfolio management tools, which allow them to track their holdings across various assets. This feature ensures investors remain informed about their overall financial health and can act quickly when market conditions change.

Strategic Decision-Making for DeFi Engagement

Investors looking to engage in DeFi can use Treno.Finance to explore and implement various stablecoin strategies. The platform’s educational materials provide insights into market dynamics, enabling users to make calculated decisions in a rapidly evolving environment.

Community Engagement and Knowledge Sharing

Treno.Finance fosters a community where investors can discuss DeFi, investing, and risk management. By joining this community, users can share insights, ask questions, and gain new perspectives from like-minded individuals, enhancing their overall investment strategies.

Frequently Asked Questions

What types of investors can benefit from Treno.Finance?

Treno.Finance is designed for a wide range of investors, including individual crypto enthusiasts, institutional investors, and professionals seeking advanced risk management tools. It caters to anyone serious about understanding and mitigating risks in their crypto investments.

How does Treno.Finance ensure data clarity and usability?

Treno.Finance prioritizes user experience by presenting complex on-chain data in a structured format. The platform’s user-friendly dashboards and detailed reports allow investors to easily access the insights they need without being overwhelmed by unnecessary information.

Can I access educational resources on Treno.Finance?

Yes, Treno.Finance provides a variety of educational resources, including strategy papers and e-books. These materials are designed to enhance users’ understanding of market dynamics and offer practical strategies for effective investment management.

How does Treno.Finance support risk assessment?

The platform offers comprehensive Risk Assessment Dossiers that analyze DeFi protocols and provide insights into potential risks. This feature is crucial for investors looking to make informed decisions and manage their exposure effectively.

You may also like:

Fieldtics

Fieldtics is an all-in-one platform for service businesses, streamlining scheduling, customer management, invoicing, and getting paid.

Moon Banking

The largest global bank dataset with AI-native integrations (MCP, OpenClaw, API). For analysts, marketers, developers, institutions.

Tailride

AI-powered invoice and receipt automation from email and web portals