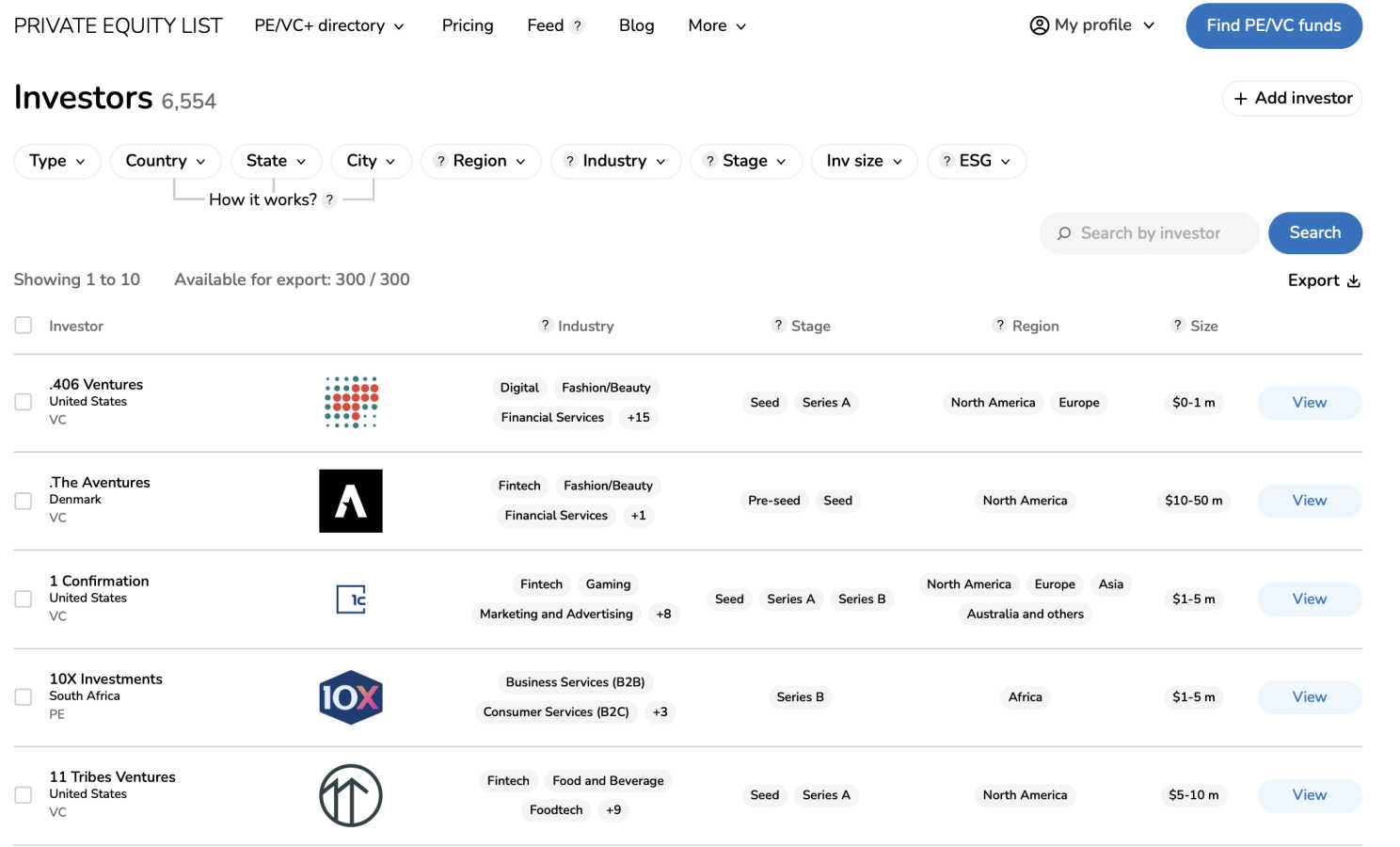

Private Equity List

Find and contact the right investors instantly with our AI-powered private equity database.

Visit

About Private Equity List

Private Equity List is an essential, AI-powered database designed for anyone who needs to find and connect with private equity and venture capital investors. It provides a targeted, cost-effective alternative to expensive, complex platforms like Pitchbook and Crunchbase. The platform's core mission is to deliver a super-intuitive user experience with powerful, PE/VC-specific search filters, enabling users to create actionable investor lists in minutes, not days. It is a critical tool for startups, consultants, VCs, universities, and business owners who require accurate, up-to-date investor data for fundraising, partnerships, and research. With over 10,300 users, its value proposition is clear: effortless access to structured, human-curated data on thousands of active funds and investment team contacts, all available without a mandatory demo and at a fraction of the cost of enterprise solutions.

Features of Private Equity List

AI-Powered Search Function

This essential feature allows for natural language queries to find investors, drastically speeding up initial research. Instead of manually configuring multiple filters, users can describe their ideal investor profile, and the AI will return targeted results. It is a critical tool for brainstorming and building a foundational list, though users are advised to verify details for accuracy as with any AI system.

Super Intuitive Search & Filters

The platform is built with a lightweight, user-friendly interface featuring powerful, purpose-built filters. You can filter investors by geography, investment stage, thesis, ticket size, and status to drill down to the most relevant targets. This precise filtering is a necessity for creating a qualified, actionable shortlist for outreach, avoiding the analytics overload of larger databases.

Investor Contact Enrichment

Gaining direct access to decision-makers is non-negotiable for fundraising. Private Equity List provides enriched contact details for investment team members, including roles and email addresses. This feature eliminates the need for separate contact-finding tools and is export-ready, allowing you to integrate this crucial data directly into your CRM or outreach campaigns.

Fresh & Curated Fund Data

The database is updated nearly daily and focuses on listing only active funds, including newly launched funds eager to invest. This ensures you are not wasting time on investors who are no longer active or have closed their funding cycles. The human-curated approach prioritizes quality and relevance over sheer volume, delivering reliable data you can trust for critical outreach.

Use Cases of Private Equity List

Startup Fundraising

Founders at any stage, from pre-seed to Series C, must efficiently identify and contact potential investors. This platform is necessary to cut through the noise, allowing startups to quickly build a targeted list of investors by stage, geography, and thesis, significantly accelerating the fundraising timeline and connecting them directly with investment team contacts.

Consultant & Advisor Deal Sourcing

Consultants and M&A advisors require precise investor and buyer lists to close client mandates and earn success fees. This tool is essential for creating tailored, export-ready shortlists for fundraising or acquisitions, providing the structured, verified data needed to present credible opportunities and move deals forward faster.

VC Ecosystem Partnership Development

For venture capital funds, accelerators, and venture studios, finding co-investors and strategic partners is critical. The database provides access to over 7,000 global PE/VC funds, making it a vital resource for due diligence, syndicate formation, and securing follow-on funding for portfolio companies from aligned partners.

Academic & Market Research

Universities, journalists, and government researchers need reliable, structured data on investment trends and market activity. Private Equity List serves as an indispensable source of intelligence for reports, analysis, and studies, offering an affordable and accessible window into the global private capital landscape without enterprise-level costs.

Frequently Asked Questions

What makes Private Equity List different from Pitchbook or Crunchbase?

Private Equity List is a targeted, best-value alternative focused specifically on PE/VC investor data. It offers a more intuitive, lightweight user experience with essential filters readily available, human-curated data, and direct contact enrichment at a much more affordable and transparent price point, avoiding the complexity and high cost of larger platforms.

Is there a free plan available?

Yes, you can try basic functions for free without requiring a credit card. This allows you to test the AI search and core filtering capabilities. For full access to enriched contacts, detailed fund information, and export functionality, a paid subscription is necessary.

How current is the data on the platform?

The database is updated nearly daily and focuses on listing active funds. A dedicated "New PE/VC" section highlights funds launched in the last 6-12 months. The platform emphasizes quality and current activity over sheer historical volume, which is essential for effective outreach.

Can I export the investor lists I create?

Absolutely. The ability to export your filtered, structured lists is a core feature. You can export data, including enriched investor contacts, for use in spreadsheets or CRM systems. This export-ready functionality is critical for taking actionable steps after your research is complete.

You may also like:

QR Menu Ninja

QR Menu Ninja lets restaurants create fast, mobile-friendly QR code menus that are easy to update, share, and manage—no apps required.

Beeslee AI Receptionist

Beeslee AI Receptionist answers calls and books appointments 24/7, ensuring you never miss a lead or opportunity again.

Golden Digital's Free D2C Marketing Tools

Unlock growth with free AI-driven D2C marketing tools for ecommerce brands scaling from $2M to $50M.