Sixfold

About Sixfold

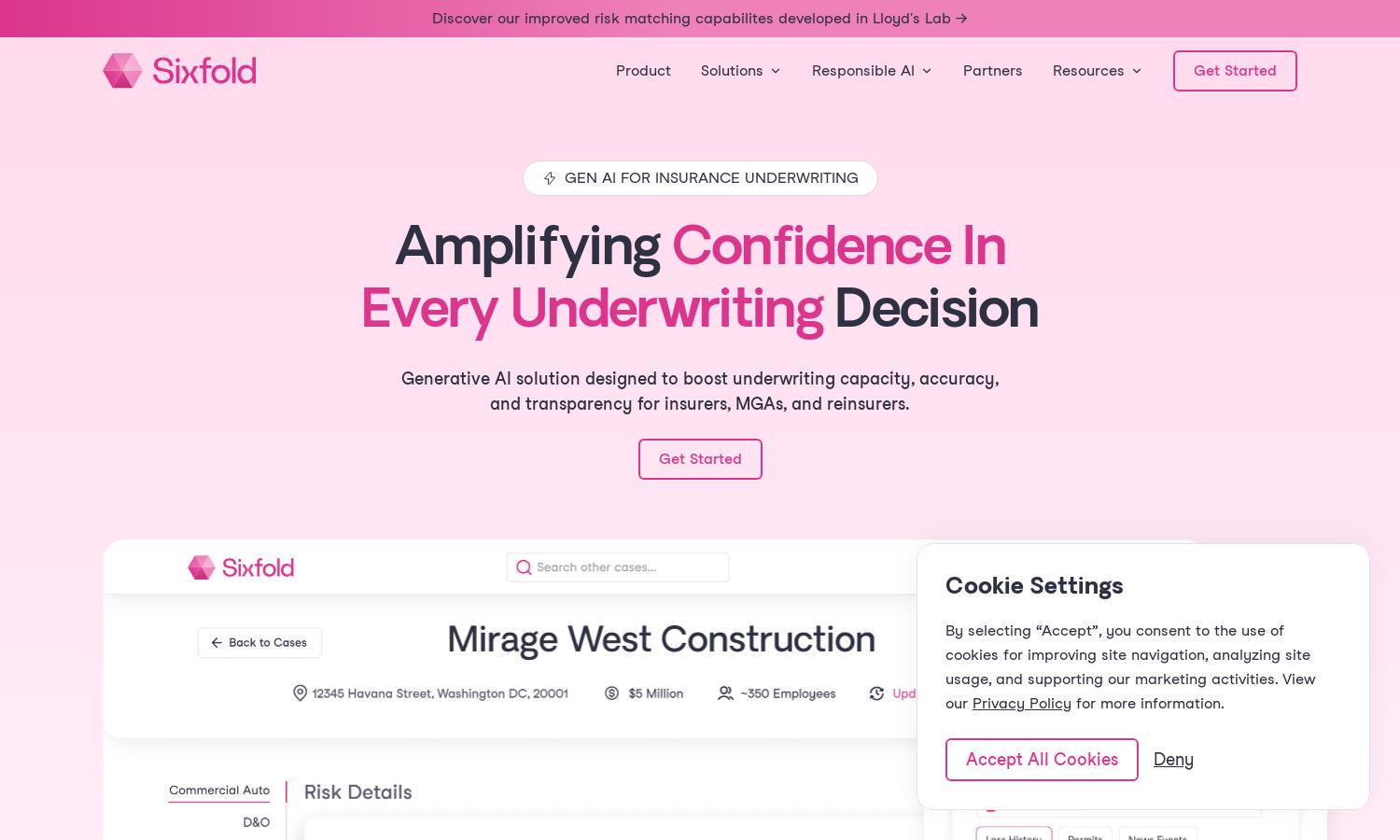

Sixfold is an innovative platform designed for insurance underwriters, utilizing generative AI to automate workflows and enhance risk assessment. By ingesting underwriting guidelines and extracting relevant data, it delivers tailored recommendations, ensuring underwriters work efficiently and accurately, ultimately transforming the underwriting process.

Sixfold offers flexible pricing plans, providing valuable features at each tier. Users benefit from tailored solutions that enhance their underwriting processes, with more advanced capabilities available through upgraded subscriptions. Investing in a higher tier unlocks greater insight and efficiency, ensuring enhanced risk management for insurance professionals.

Sixfold features a user-friendly interface designed for seamless navigation, ensuring an optimal user experience. The layout presents critical information clearly while highlighting AI-driven functionalities that simplify underwriting tasks. Users can easily access tailored recommendations and insights, promoting efficient decision-making in insurance underwriting.

How Sixfold works

Users interact with Sixfold by first ingesting their underwriting guidelines into the platform. After onboarding, they can easily navigate through submissions, where the platform extracts pertinent risk data from supporting documents and third-party sources. This process generates summarized insights and tailored recommendations, allowing underwriters to efficiently manage submissions and assess risk factors with transparency and precision.

Key Features for Sixfold

Automated Risk Insights

Sixfold's automated risk insights utilize generative AI to transform the underwriting process, helping underwriters by providing precise recommendations based on data analysis. This innovative feature streamlines decision-making, ensuring users can tackle challenges effortlessly while improving efficiency in insurance underwriting practices.

Comprehensive Data Extraction

Sixfold excels in comprehensive data extraction, sourcing vital information from underwriting submissions and third-party documents. This feature enables users to maintain accuracy in risk assessment without manual effort, showcasing how the platform enhances operational efficiency and drives better underwriting outcomes.

Transparency in Decision-Making

Sixfold promotes transparency in decision-making by providing full sourcing and lineage of all underwriting decisions. This feature ensures that users can trace inputs and outputs, fostering trust and compliance with industry standards while enhancing the overall accountability of the underwriting process.