Pennyflo

About Pennyflo

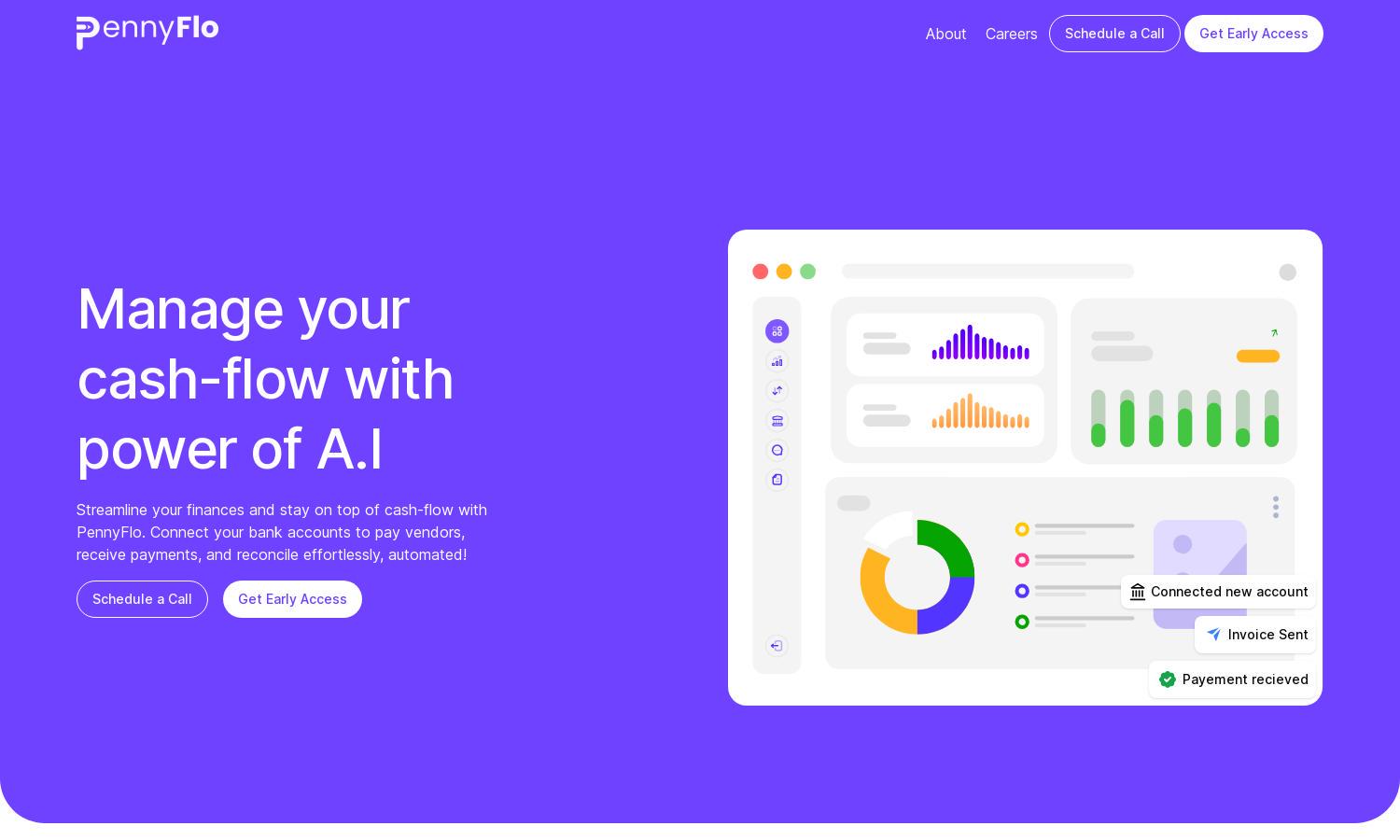

Pennyflo is an innovative AI cash management suite designed for businesses, providing real-time cash flow insights and automation. It helps finance teams collaborate and streamline tasks, offering dynamic forecasting and data visualization. With Pennyflo, businesses can efficiently manage cash flow, reduce risks, and make informed financial decisions effortlessly.

Pennyflo offers flexible pricing plans tailored for different business needs. Each subscription tier provides unique features such as automated banking, cash flow forecasting, and data analytics. Upgrading unlocks advanced functionalities that enhance financial management, ensuring businesses can optimize their cash flow and mitigate risks effectively.

Pennyflo's user interface is designed for seamless navigation and ease of use. Its intuitive layout allows users to access real-time cash flow data, automate workflows, and generate reports effortlessly. With user-friendly features, Pennyflo ensures an efficient browsing experience, empowering finance teams to manage their cash flow effectively.

How Pennyflo works

Users begin their Pennyflo journey by signing up and completing a simple onboarding process. Once onboarded, they can easily navigate the platform to access intuitive dashboards, where they can view real-time cash flow insights. The software automates banking reconciliations and generates comprehensive reports, enhancing efficiency in cash management while minimizing errors.

Key Features for Pennyflo

AI-Powered Cash Flow Management

Pennyflo's AI-powered cash flow management feature transforms how businesses handle their finances. It provides real-time insights and predictive analytics, enabling users to foresee financial scenarios. This innovative capability not only improves cash flow visibility but also empowers teams to make data-driven decisions swiftly, enhancing overall financial stability.

Automated Banking & Reconciliations

With Pennyflo's automated banking and reconciliations feature, users can streamline their financial operations significantly. This functionality reduces manual errors, saves time, and ensures accuracy in financial reporting. By automating these processes, Pennyflo helps businesses maintain a seamless cash management experience while focusing on growth and profitability.

Dynamic Forecasting

Pennyflo's dynamic forecasting feature leverages historical data to predict future cash flow scenarios. This powerful tool enables businesses to plan effectively and make informed decisions based on reliable forecasts. By utilizing this feature, users can mitigate cash shortages and adapt proactively to changing financial landscapes, enhancing overall business strategy.

You may also like: