MyUser

About MyUser

MyUser offers a streamlined financial solution for businesses, facilitating efficient online payment processing with instant payouts. Designed for high-growth startups, the platform ensures rapid approvals and eliminates disputes or holds, empowering users to focus on growth while ensuring smooth cash flow management.

MyUser's pricing starts at 2% per successful payment, with special discounts for Ycombinator participants. Users enjoy a $1 fee per login and initiated payment, providing great value and affordability for startups aiming to optimize their payment processes and maximize cash flow efficiency.

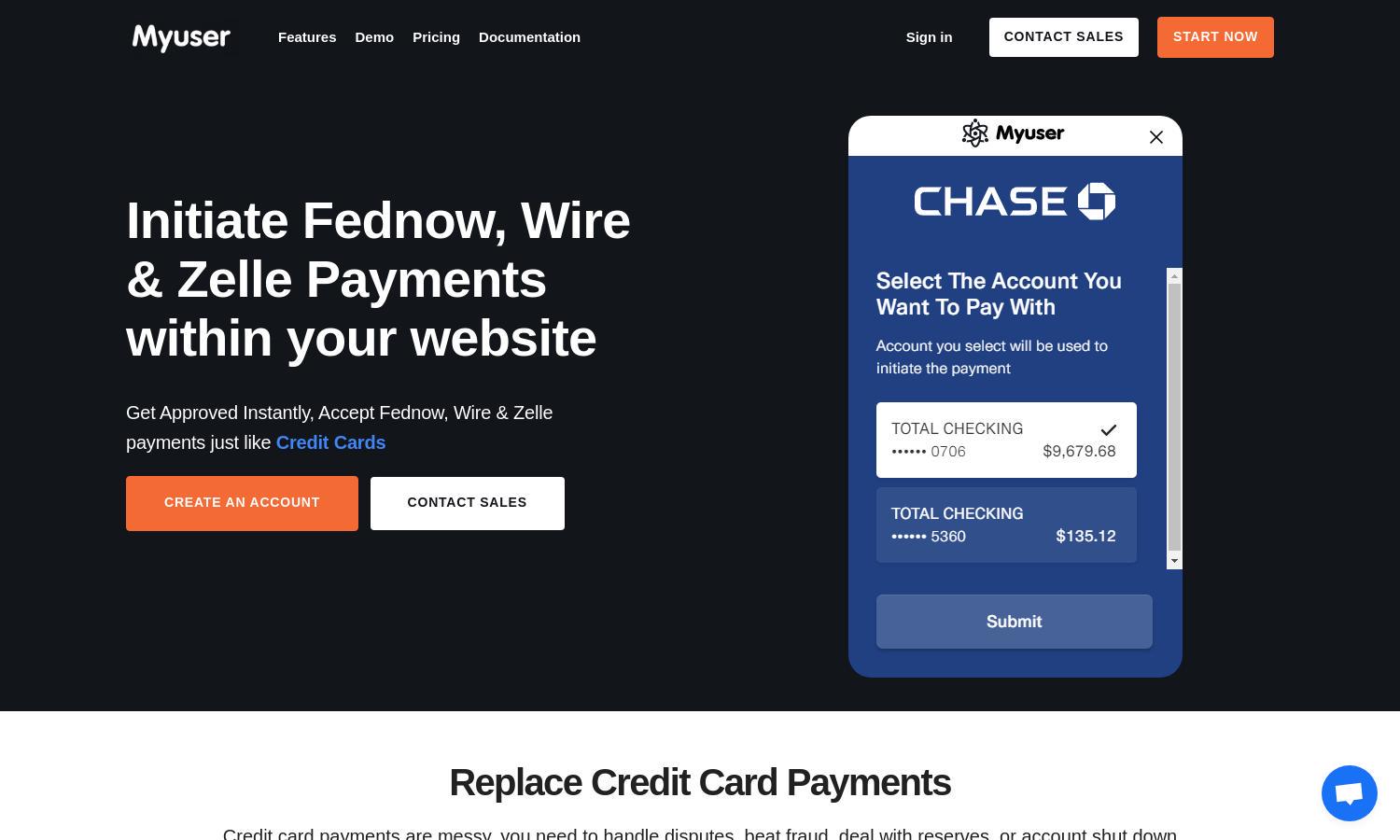

The MyUser interface is designed for seamless navigation, offering an intuitive layout that enhances user experience. With user-friendly features for quick payments and updates, MyUser supports businesses effectively and encourages efficient interactions, allowing users to manage their financial infrastructure effortlessly.

How MyUser works

Users begin by signing up on MyUser, where approvals are typically instant. Once integrated via a simple API, they can start accepting payments immediately. MyUser provides real-time updates on transaction statuses, ensures instant payouts to the user's bank, and eliminates issues like disputes or reserves.

Key Features for MyUser

Instant Payouts

MyUser's Instant Payouts feature allows users to receive payments directly from customers' banks, ensuring immediate transactions. This innovative capability eliminates delays associated with traditional payment methods, benefiting businesses by enhancing cash flow and providing timely access to funds.

Real-Time Payment Notifications

The Real-Time Payment Notifications feature of MyUser enables businesses to receive immediate updates on transaction approvals or declines. This ensures transparency and quick decision-making, allowing users to monitor their finances effectively and respond promptly to changes in payment statuses.

No Holds or Disputes

MyUser eliminates holds and disputes, allowing payments to be initiated directly by users, which enhances transaction security. This unique feature protects businesses from common payment processing issues, ensuring reliable cash flow and reducing administrative burdens related to payment disputes.